From emerging startups to established enterprises, companies across the world are geographically expanding their teams to unlock unparalleled growth and diversity. Accessing this vast global talent pool can boost productivity, cut costs, and increase revenue from new markets—all while getting ahead of the competition.

However, these exciting opportunities come with challenges, such as managing global payroll processing. Specifically, companies will likely face unfamiliar tax regulations and must navigate complex benefits laws and worker classification rules—and that creates uncertainty around compliance.

To help inspire more confidence when building and paying international teams, companies should familiarize themselves with the challenges and solutions presented in this global payroll compliance guide.

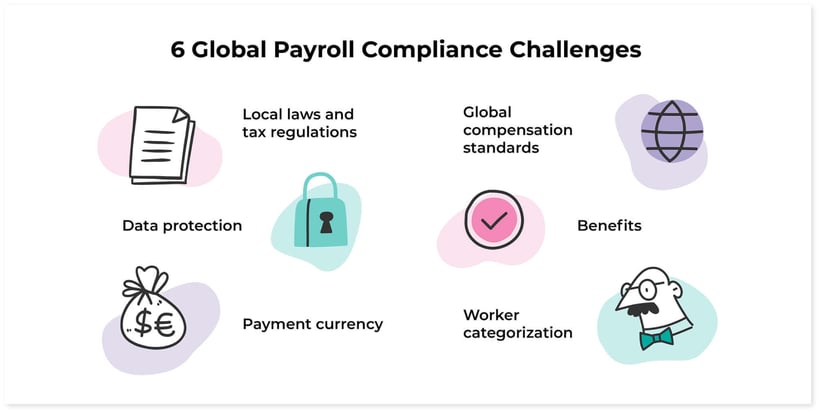

6 Global Payroll Compliance Challenges

Developing a compliant and productive global payroll system without expert guidance can prove daunting and demanding; it requires an extensive comprehension of diverse local and international regulations and processes.

Below are six of the most significant global payroll challenges companies will face when expanding into new markets.

1. Local laws and tax regulations

Tax payment withholding requires careful planning and compliance to ensure employees are taxed accurately, regardless of location or jurisdiction. This requires organizations to stay up to date with ever-changing regulations and policies from foreign governments.

2. Data protection

Employee payroll details are highly confidential and demand robust safeguarding measures. Although payroll companies might be well-versed with data protection regulations in their native countries, administering global payroll mandates adherence to data laws in diverse locations, such as GDPR in Europe or PDPA in Singapore.

3. Payment currency

Defining how and when to pay employees who work in other countries is vital. It’s crucial to consider that the location can affect the currency used and the laws that apply to employment. Similarly, companies must anticipate navigating (and paying) foreign exchange fees in many markets—something that can easily go awry if in-house payroll teams are not on top of the most up-to-date rates and timely payments.

4. Benefits

Companies must be attentive to the varied statutory benefits provided to each global worker in their respective country. Pension obligations, sick leave, health insurance, and maternity leave can considerably differ from one country to another. For example, in Mexico, all employees have the right to guaranteed benefits. Companies may attract local authorities’ ire and subsequent action or, at the very least, lose out on key talent should they not meet country-specific benefits requirements.

5. Global compensation standards

It's important to consider salary disparities across borders. For instance, if a company recruits software developers from the U.S. and Canada, their roles may be identical but their pay will likely differ because of differences in taxes, market norms, benefits, contributions, and currency exchange rates.

6. Worker categorization

Understanding the distinctions between employee and contractor classifications is critical to correctly categorizing international employees, preventing legal penalties, and safeguarding a company's intellectual property. Employee misclassification remains a significant concern when hiring overseas; it may lead to stiff fines, penalties, damaged reputation, and, ultimately, enough difficulty to not make staying in the country worth it.

Solving International Payroll Problems

Global payroll compliance can be challenging, but there are viable solutions available—some more extreme than others. The EY 2022 HR Processing Risk and Cost Survey showed that, of surveyed organizations facing litigation as a result of payroll errors:

- 44% resorted to cutting jobs

- 35% experienced increased employee turnover

- 28% saw operational costs increase

Fortunately, companies can align with local payroll regulations without having to cut positions by choosing between the following effective options for mastering global payroll.

Employer of Record

A global Employer of Record (EOR) helps businesses hire, onboard, and pay workers from other countries without needing to create an expensive, time-consuming legal entity. An EOR serves as the legal entity on paper and manages various immigration aspects, including work permits, visas, and tax payments using its Taxpayer ID on behalf of the business.

But how does an Employer of Record help with managing global payroll?

Because managing payroll obligations and statutory contributions can be a complex and time-consuming job, relying on an Employer of Record can alleviate the stress of issues ranging from foreign currency exchange to delayed tax filings.

A global Employer of Record service simplifies these issues by handling all aspects of employee compensation, including:

- Payroll requirements

- Voluntary benefits

- Onboarding

- Offboarding

- Expense reimbursements

- And more

They can also assist with registering staff with local authorities and organizing work permits and visas.

International payroll outsourcing

Another option for managing global payroll is to evaluate international payroll companies that can handle everything for an expanding company and select the one with the most experience in the target market(s).

Often, an international payroll provider is based in the country where the organization is operating, so they already know the laws about protecting workers.

By engaging a payroll company, they can entrust them with managing tax liabilities, compliance, paid time off, and various other responsibilities that come with payroll management. This can be particularly advantageous for a newly established international business.

However, it’s important to keep in mind that this is essentially all that a payroll company can and will do, and while it may be a valuable investment, there may be other factors to consider.

Shadow payroll

Some companies send employees to another country to explore new markets, improve working relationships with foreign branches, or build connections across different regions.

However, organizations must continue to employ the worker while satisfying legal requirements in the destination country. One way to achieve this is by implementing a shadow payroll system.

Put simply, shadow payroll manages the tax liabilities of an expat worker during their overseas assignment.

Using a shadow payroll, the employee remains on their home country’s payroll. This means the payroll in the host country will ‘shadow’ what is being reported in the employee’s home country.

Global Expansion Solves Global Payroll Compliance Issues

It can be difficult to pay employees in multiple countries due to different payroll and tax rules. Doing so can take a lot of time and mistakes can easily happen when calculating payroll rates and taxes for each location.

With Global Expansion's Employer of Record services, you can simplify your global payroll processes by having them in one easily accessible place.

Our team of global payroll experts pays your international employees accurately and in their local currencies—on time, every time. Plus, our award-winning software eliminates paperwork, as all reports are digital.

We can also assist with a "shadow payroll" option that enables the employee to remain on their home country's payroll. This approach protects organizations from potential fines and penalties associated with non-compliance while an employee is living abroad.

Discover why Global Expansion is your best solution for compliant global payroll and your team’s legal and HR responsibilities. Get Global Payroll Now.

Subscribe to our blog

Receive the latest GX blog posts and updates in your inbox.