Hiring beyond borders isn’t straightforward—and managing global payroll for a distributed workforce only adds to the challenge once employers hire the right candidates. Without expert assistance, paying multi-country teams can create multi-country headaches: navigating national, regional, and local tax regulations, employment laws, and compliance measures creates complexity for even the most-tenured organizations.

To build a strong foundation to support international teams, employers must consider their global payroll systems.

What is Global Payroll?

Global payroll refers to the onboarding and managing of payroll for international employees. It involves tracking paid time off, work hours, and payroll records, and paying employees in different countries. While not dissimilar to executing domestic payroll, different countries have different requirements, which can create confusion for domestic payroll specialists unfamiliar with other countries’ employment laws.

Global payroll processing will include a variety of tasks and local law familiarization, including:

- Calculating wages and exchange rates

- Following minimum wage laws (national, territorial/provincial, local)

- Executing tax payment withholding and settling

- Distributing pay slips

- Administering mandatory and supplementary benefits and bonuses

- Ensuring data protection

- Classifying employees correctly

Some countries require employer contributions to pension schemes or social security, while others require healthcare benefits or a certain amount of paid time off. Employers must familiarize themselves with some of the key differences between global and local payroll.

Global Payroll vs. Local Payroll

With local payroll, companies only have one set of laws and legislation to comply with. Global payroll imparts a completely different set of rules and regulations for every country. Additionally, many countries, including the United States and Canada, have federal laws plus state and provincial/territorial laws, respectively. This means payroll specialists must contend with multiple employment laws per country.

Managing global payroll only becomes more challenging when operating in more than one foreign market. For example, a U.S. company with employees in India and Germany faces compounded challenges; each has different currencies, payment methods, employee benefit requirements, minimum wage laws, and exchange rates, as well as tax regulations and employee classifications. These country-specific considerations can quickly create problems for In-house payroll specialists.

How does Global Payroll Work?

Companies can give global payroll management duties to their in-house human resource teams. But in most cases, businesses will utilize an external payroll management company’s services. These businesses do the heavy lifting on behalf of partnering companies, many with refined expertise in handling payroll in multiple countries.

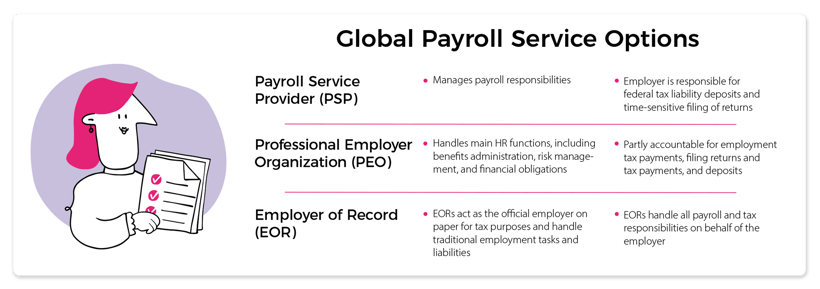

Three main global payroll service options are available.

Payroll Service Provider (PSP)

A payroll service provider will manage a company's payroll responsibilities, such as direct deposit or check payments for employees, quarterly or yearly tax reports, and tax-related payments. With a PSP, the employer remains responsible for federal tax liability deposits and time-sensitive filing of returns. These services are mostly for businesses that handle local payroll and don’t have an in-house team.

Professional Employer Organization (PEO)

Professional Employer Organizations handle the main HR functions, including benefits administration, risk management, and financial obligations such as payroll, tax, and compliance. They’re partly accountable for employment tax payments, filing returns and tax payments, and deposits.

PEOs often share these responsibilities with their clients, functioning as co-employers, and they’re a good option for small to midsize businesses, but only if their budgets can keep up with business expansion, as PEOs can become expensive quickly.

Employer of Record (EOR)

Employer of Record providers take on traditional employment tasks and liabilities and, for tax purposes and benefits, act as the official employer on paper while the worker performs their duties for the company that hired them. This service is a great option for global payroll purposes: the EOR handles all payroll and tax responsibilities, saving their clients time, labor, and money. An Employer of Record offers a hands-off global payroll experience delivered by multi-country payroll experts.

Challenges of Global Payroll

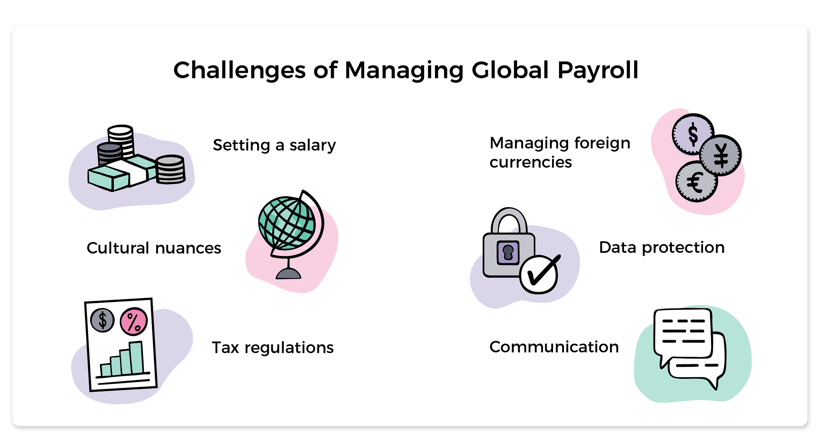

Utilizing global payroll services can offer many benefits. However, employers face several considerations before selecting a global payroll provider—or doing it on their own.

1. Setting a salary

Much like setting salaries for domestic employees, employers must strike a balance between fair compensation and cost efficiency. When building a global team, employers must consider local wages/salaries relative to what a domestic employer with similar credentials would earn.

2. Cultural nuances

To navigate cultural nuances and differences, employers should consider implementing adaptations to payroll practices to align with foreign employees’ societal norms, expected benefits, and attitudes toward work, helping maintain employee satisfaction and retention.

3. Tax regulations

Paying employees in multiple countries means differentiation in payroll factors such as local labor laws, income tax, and regulations. It’s crucial that companies ensure they align with local legislation for each country in which they have an employee. With regular changes in legislation, this can be a difficult task for in-house payroll teams to handle.

4. Managing foreign currencies

Companies must convert their employee payments to the relevant local currency. This can involve additional costs and potential risks associated with exchange rate fluctuations.

5. Data protection

Employers must tread carefully when managing employee payroll data. To handle this data appropriately, businesses should make sure their employee data is accurate, up to date, and secure. Managing data protection in (and across) multiple countries means employers must also meet each country’s respective data protection requirements which vary greatly.

6. Communication

Handling payroll across multiple countries can be a challenge when it requires maintaining clear and consistent communication with various stakeholders. To overcome this, employers must implement effective communication systems to provide transparency and clarity across the board.

Benefits of Global Payroll

By partnering with EORs, companies can unlock a cost-effective and effortless way to handle payroll challenges. Working with a global payroll provider may be the best route for international hiring.

1. Legal compliance

Global payroll providers know the ins and outs of complex, country-specific legislative rules and can align with local compliance musts, in turn offering payroll expertise. They reduce the risk of legal troubles and enhance a business’s reputation by portraying it as a reliable employer.

2. On-time payments

With a global payroll partner or Employer of Record to handle multi-country payroll, companies can provide consistent payroll services to workers across multiple countries. This can improve employee satisfaction and experience by supplying workers with accurate and timely payments—which employees in every country expect.

3. Improved efficiency

Working with global payroll providers is cost-effective, time-efficient, and improves overall business productivity. With advanced payroll software to calculate payments, withhold taxes, and reduce in-house payroll teams’ workloads, the potential for errors and inaccuracies is significantly reduced.

4. Safely stored employee data

Having a reliable global payroll provider in place to handle a company’s HR needs will offer peace of mind, knowing that all employee data is stored within secure systems which only approved parties can access.

5. Systems of communication

Communication plays an essential role in supporting stakeholder satisfaction. Experienced global payroll providers will have optimized communication systems in place that are punctual, reliable, and efficient.

6. Simplification of HR administration

Global payroll solutions give managers access to easy-to-use tools. By partnering with established global payroll providers, client companies can review vital information on their employee data, tax payments, and payroll schemes across six continents.

What are the Compliance Requirements Associated with Global Payroll?

Legal compliance

Compliance is an essential part of any payroll system. To align with global payroll local laws and regulations, employers must first understand their responsibilities for international hiring. They must provide:

- The correct type of employment contract, e.g. employee or contractor.

- On-time tax payments as well as other country-specific obligations.

- Core employee benefits and additional benefits to attract high-level talent.

- Legal registration of their presence in the local market for both the business and each employee.

- Consistent upkeep of rule amendments.

Global payroll management service providers navigate this complex web of compliance measures so organizations don’t have to. They make sure their records are up to date with any alterations to tax regulations and labor laws in numerous countries.

Data compliance

Anyone collecting data on those inside the European Union, the European Economic Area, and/or the United Kingdom, must comply with local and continent-wide data laws. The GDPR (General Data Protection Regulation) has seven key principles:

- Lawfulness, fairness, and transparency

- Purpose limitation

- Data minimization

- Accuracy

- Storage limitation

- Integrity and confidentiality

- Accountability

According to Accountable HQ, GDPR is considered a “major roadblock” that is “extensive, complex and oftentimes overwhelming.” Having also been described as “one of the most stringent data protection laws in the world today,” maneuvering in-house teams around these rules and regulations may be a considerable risk to take. That’s why EORs often function as the best option to align with GDPR compliance measures for international hiring and global payroll.

Global Expansion's Global Payroll Services

As your business continues growing into different countries, you’ll want to make sure you choose the best global payroll service provider available. Whether it’s for one employee or 100, Global Expansion can help.

Global Expansion is an international Employer of Record (EOR) that offers tailored solutions to meet your business' global payroll needs. Our people-first approach helps your organization:

- Navigate complex international payroll requirements.

- Pay international team members on time, every time.

- Facilitate rapid business growth.

- Reduce costs and save money.

Additionally, our centralized service coordinates all of your payroll options and puts them in one place. With payroll experts located around the world, ensuring quality insights and up-to-date information on country-specific laws and local regulations is a breeze.

Our award-winning software and tech integrations allow you to oversee your human resource operations with ease, eliminating the hassle of tedious paperwork and keeping you in the loop with complete control over your international payroll.

Get in touch to learn more about how Global Expansion can support your company’s global payroll initiatives.

Subscribe to our blog

Receive the latest GX blog posts and updates in your inbox.