Labor Laws in Mali

- Annual Leave: 30 days

- Maternity Leave: 14 weeks

- Public Holidays: 12

- Workweek: 40 hours per week.

Get everything you need to hire talent in Mali. Download our comprehensive guide for hiring in this expanding market.

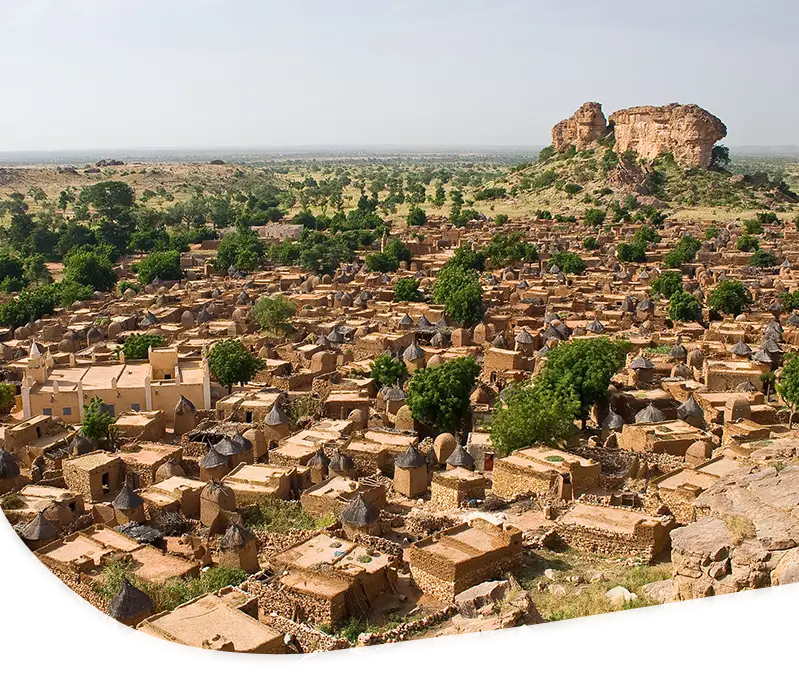

Capital:

Bamako

Languages:

Bambara, French

Currency:

West African CFA franc

Please enter the following information:

Income Tax in Mali is progressive and ranges from 0% to 40%.

The standard VAT Rate (GST) is 18%.

In Mali, both employers and employees contribute to social security. The contributions are as follows:

The visas available to legally work in Mali include:

Work Visa

Temporary Work Permit:

Long-term Work Permit:

Application Process

Setting up a company in Mali can be expensive and complex. Global Expansion simplifies your entry into this market.

We handle hiring, HR, and payroll while ensuring compliance with local regulations, all without establishing a local entity.

Our Mali Employer of Record (EOR) solution lets you focus on your business growth.