With the rise of globalization, more businesses are hiring in new countries to build a global workforce and to eclipse their competition. However, hiring international employees can create many challenges, especially when it comes to international payroll management.

A Global Payroll Management Institute survey revealed that 70% of the participants identified compliance as their primary obstacle in managing international payroll, with 33% citing working with multiple vendors and 27% facing language barriers.

These findings highlight the complexities of international payroll and the need for professional global payroll services to help businesses navigate these challenges. A global payroll platform can help streamline payroll operations, ensure accuracy and compliance, and maintain employee satisfaction.

What is International Payroll?

International payroll refers to the process of managing and processing employee compensation and benefits for a global workforce while complying with local tax laws and regulations.

International payroll is an important process, as it involves human resources, taxation, finance, and the legal ramifications of different countries' labor laws. Companies operating in multiple countries, states, and/or jurisdictions must be aware of each country's intricacies regarding local taxes, employee benefits, reporting requirements, and deductions.

Global Payroll Challenges & Solutions

Managing payroll for a global workforce is a critical concern for many businesses, and it comes with many challenges.

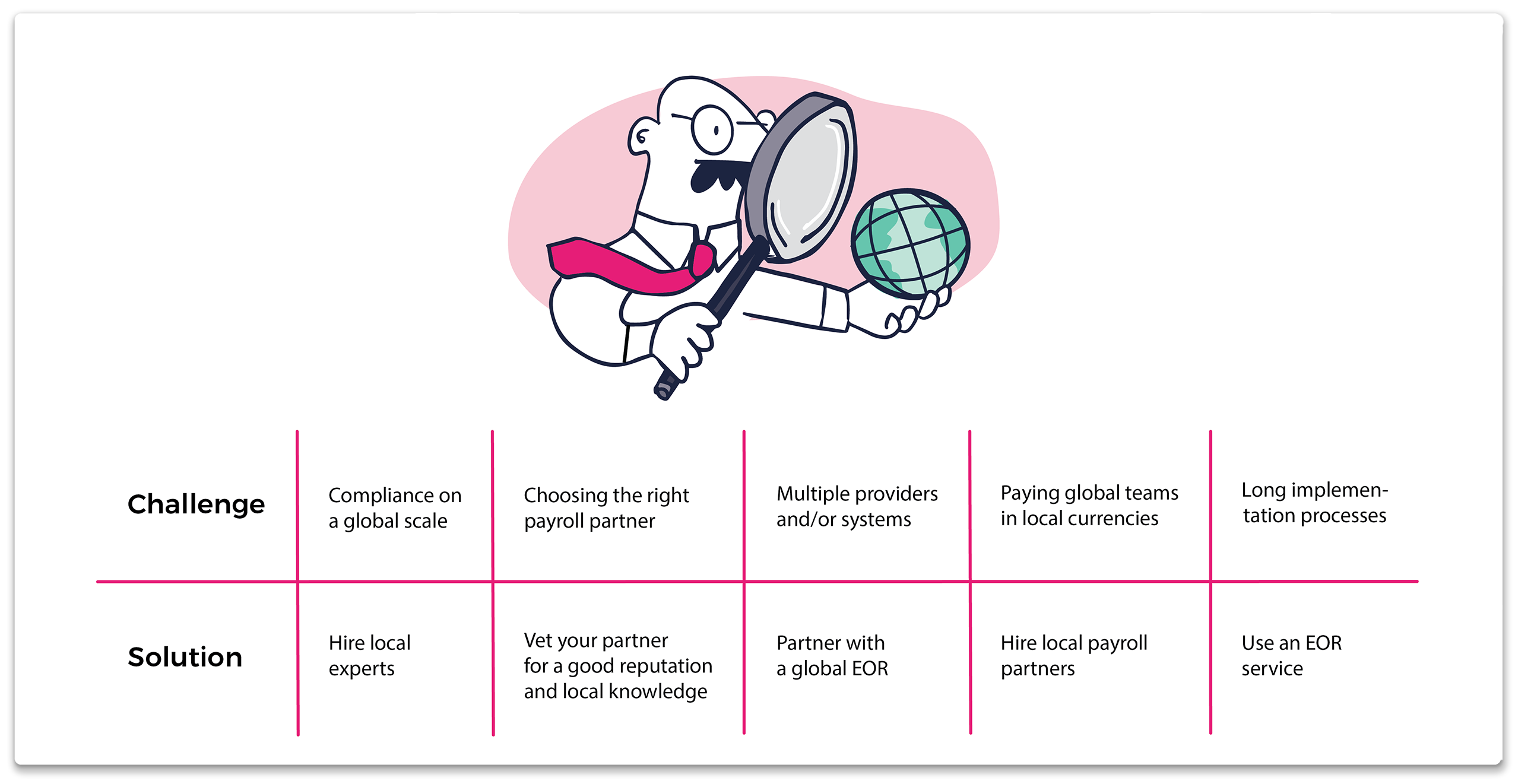

Challenge: Compliance on a Global Scale

Payroll regulations, laws, and tax requirements vary between countries, with some countries’ compliance requirements more complex than others’. Organizations must abide by national and, often, local regulations to avoid penalties and fines, maintain their reputations, and operate effectively. Managing global payroll compliance involves:

- Staying up to date with legislative changes

- Complying with different tax codes

- Navigating social security systems

- Dealing with data privacy regulations

- Cross-border currency conversions

Non-compliance can also result in delayed payroll processing, and negatively impact employee morale and retention.

Solution: Ensure the Payroll Partner has Local Experts to Avoid Non-Compliance

The most effective way to manage global payroll compliance is to partner with a payroll provider with in-country experts. Doing so aligns an organization's payroll processes with local regulations, minimizes the risk of non-compliance, and enables it to focus on its core business operations.

An Employer of Record (EOR) is a third-party entity that handles an organization’s payroll processes and global HR needs, as well as other other solutions to make operating internationally much easier. Businesses benefit from their in-depth knowledge and experience in managing compliance for global companies.

Challenge: Choosing the Right Payroll Partner

A payroll partner can significantly impact payroll processes’ compliance, accuracy, and efficiency. Working with the wrong partner can result in costly errors, missed deadlines, and non-compliance with local regulations, which can lead to additional financial and reputational damage.

Solution: Thoroughly Vet Potential Partners

Before selecting a payroll partner, organizations should thoroughly evaluate several providers, looking for:

- Experience

- Local knowledge

- Advanced technology

- Excellent customer service

- A good reputation

- Robust data security measures

- A partner with in-country experts

Businesses operating or planning to operate in multiple countries should work with a payroll partner with a strong network of quality partners in various countries, like an Employer of Record, rather than just a global payroll provider.

Challenge: Multiple Providers and/or Systems

Working with multiple payroll providers and/or systems creates its own set of problems, including:

- Inefficiency: Managing payroll across multiple providers and systems can be time-consuming. It often results in data inconsistencies, payroll processing delays, and an increased administrative burden on HR teams.

- Lack of standardization: Using multiple providers can lead to a lack of standardization in payroll processes and data. This can make it difficult to compare payroll data across different locations and ensure compliance.

- Security risks: Multiple providers and systems can also result in security risks, such as data breaches or loss of sensitive information.

Solution: Partner with an Employer of Record

An Employer of Record can offer a single system for managing payroll across multiple locations. One comprehensive payroll platform that covers every aspect of global payroll can mitigate the pain points of managing international teams and navigating multi-country laws and regulations, reducing the risk of data inconsistencies and errors.

Challenge: Paying Global Teams in Local Currencies

For companies handling global payroll, making payments in different currencies can lead to discrepancies among exchange rates and local taxes. Specialists working with local currency often stay abreast of the constantly changing exchange rates between foreign and base currencies.

Solution: Ensure Your Payroll Partners can Make Payments in Local Currencies

If you're thinking about hiring in other countries, ensure your payroll partners can accurately pay for employees. Partner with professionals experienced in multi-currency payments who can handle the complexities of transferring money internationally. Your partner should be up to date on changes in local laws and regulations so they can better combat inflation and currency fluctuations.

Challenge: Long Implementation Processes

When a business starts hiring in other countries, payroll will undergo a long implementation process. Switching systems or implementing new business procedures and applications could mean taking multiple steps with significant organizational effort over several months. Regulatory and policy changes only add complexity to the process.

Solution: Employ an EOR Service

With an EOR, businesses can quickly hire and pay employees all over the world. Many EORs leverage automation for payroll-related functions. EORs have dedicated software platforms specifically designed to manage payroll and compliance across multiple countries.

These platforms use cutting-edge technology to ensure accurate and timely payments, tax filings, and other compliance-related tasks. By automating many of these functions, EORs significantly reduce the time and resources required to manage global payroll.

Employer of Record Solutions to International Payroll Challenges

Global Expansion are experts in global payroll management and offer seamless integration with every major HRIS/HCM platform. Our EOR solution provides a comprehensive suite of services, including global payroll management, employment compliance management, and benefits administration. Outsourcing your global payroll to us simplifies your payroll management, aligns with local tax and employment laws, and improves efficiency.

Contact us today to learn more about how we can help streamline your global payroll operations.

Subscribe to our blog

Receive the latest GX blog posts and updates in your inbox.