India is known for its rich cultural heritage, diverse population, and bustling cities. With a population of over 1.4 billion people, India has one of the largest workforces in the world.

It's also currently the sixth-largest economy in the world, with a nominal GDP of approximately $3.17 trillion. Over the past few decades, the country has seen significant economic growth, with the service sector playing a crucial role in this expansion. Additionally, India's economic ties to the U.S. have helped it develop alongside the world's largest economy, providing numerous opportunities for businesses considering hiring Indian employees.

Despite the country's clear upward trajectory in regard to business opportunities, it's important to understand the ins and outs of hiring in India.

Hiring Employees in India

Hiring employees in India is a complex process that requires careful attention to local laws and regulations.

Labor laws and minimum wage in India

When hiring in India, it’s important to understand India labor laws to avoid unintentional mistakes that could lead to significant fines, penalties, or other economic headaches. For example, employers must provide employees with the proper amount of annual leave, which can range from 15 to 20 days a year.

Concerning minimum wage, India, unlike many nations, doesn’t have a national minimum wage, but some state governments have established minimum wages that employers need to be aware of. Employers can risk navigating these discrepancies on their own, or rely on a local expert or Employer of Record to meet wage compliance.

Taxes

Employers also need to make sure that they abide by all tax laws in India. India currently has two tax regimes that employees can choose from. The newer regime has fewer tax exemptions but lower tax rates. Employers need to ensure that they provide tax documentation to employees by June 15th each year, so they have enough time to file their taxes before the July 31st deadline. Additionally, companies need to make sure they make the proper payments for property tax, dividend tax, and more.

Employee policies and contracts

Hiring in India can look different for every business. For example, there are four types of employees in India.

- Permanent contract employees who work according to the employment contract signed and whose employment doesn't have a fixed expiration date.

- Fixed-term or open-ended contract employees whose agreement is outlined with the employer.

- Casual employment workers who have a fixed number of working hours with an end date agreed upon beforehand.

- Zero-hour work contract employees who don’t have set hours and can work for multiple employers.

Permanent establishment laws

If employers intend to have a stable and ongoing presence in India, they need to make sure they follow the permanent establishment laws of the country. Permanent establishment laws determine whether a foreign business is considered to have a taxable presence in India and, if so, how it’s taxed.

Under these laws, employers must consider factors such as how regularly they do business in India and if they have a permanent location there. If the company is legally required to pay a certain amount of taxes due to permanent establishment laws and fails to do so, it could face serious consequences for failing to stay in compliance with the laws.

Cost of Hiring Employees in India

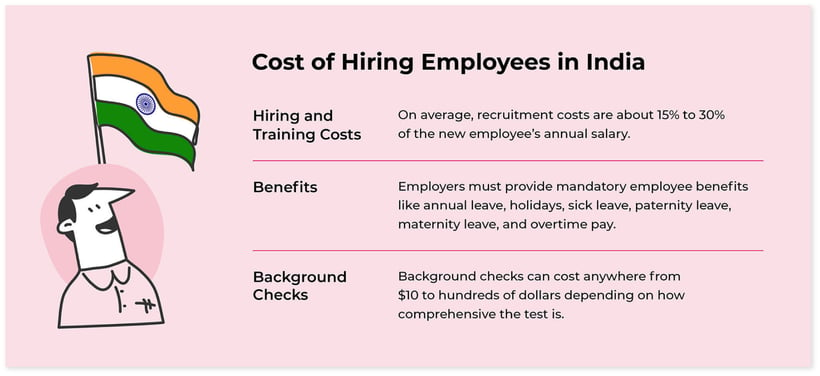

Understanding the cost of hiring employees in India is crucial before building a team in-country.

Hiring and training costs

Recruitment and training costs can vary significantly depending on the industry and level of expertise needed for the role. Some companies choose to use a hiring agency if they don’t have their own in-house recruitment department. Either way, recruiting in India can come at a high cost. On average, recruitment costs are about 15% to 30% of the new employee’s annual salary, not to mention the productivity loss that comes when a position isn’t filled. This doesn't include the average cost of $1,252 that it takes to train a new employee.

Benefits

While benefits play a crucial role in attracting and retaining employees in India, some are also mandatory by law. For example, benefits like annual leave, holidays, sick leave, paternity leave, maternity leave, and overtime pay are mandatory. Additionally, employers must dedicate a portion of an employee’s salary to the Employees' Provident Fund, Employees' Pension Scheme, and Employees' Deposit Linked Insurance Scheme.

Background checks

Background checks are an essential step in the hiring process in India, as they help ensure that companies make informed decisions about potential employees. While this is always a possibility when hiring anywhere, it’s especially important if hiring employees whom employers will have limited contact with. Background checks can cost anywhere from $10 to hundreds of dollars, depending on how comprehensive the test is.

What a Company Needs to Hire in India

Companies have several options to hire employees in India, including establishing their own legal entity, hiring independent contractors, or utilizing an Employer of Record (EOR) services.

Legal entity

Many companies decide to open up an overseas entity when hiring in India. By setting up an entity, companies can also establish a local presence and build relationships with local stakeholders, which can be beneficial for long-term growth and success. While there are benefits to doing this, it’s also important to remember that they must obtain licenses and compensation insurance and also pay taxes according to India’s laws when they operate an overseas entity.

Additionally, companies must anticipate paying tens or hundreds of thousands of dollars in set-up and maintenance costs—on top of dozens of hours and internal resources dedicated to the process.

Independent contractors

One popular option is to hire contractors rather than full-time employees. The benefit of this is that the relationship with a contractor is more flexible; employers can work with them for as long or as limitedly as needed. This can help cut costs compared to hiring full-time employees whom employers must provide benefits for.

Despite these relative advantages, employing contractors imparts risks, as employers need to make sure that they don’t accidentally commit misclassification errors that come with fines and legal issues.

Employer of Record (EOR)

Using an Employer of Record (EOR) can be beneficial when hiring in India, especially for companies that want to enter the market quickly or want a simpler way to meet compliance. A full-service EOR handles compliance monitoring tasks, payroll, taxes, benefits, and human resources. This allows companies to focus on their core business activities while complying with local laws. Additionally, an India Employer of Record can provide local expertise and support and help streamline operations.

Trust Global Expansion as Your EOR Partner to Hire in India

Skip the hassles, headaches, and financial investment of hiring employees in India under your own entity by utilizing Global Expansion’s Employer of Record solution. By partnering with Global Expansion, you can onboard talent in a matter of days—not weeks or months—and capitalize on time-sensitive opportunities while aligning with all Indian employment laws.

Discover how simple expanding into one of the world’s most promising markets can be with an experienced Employer of Record by your side. Reach out to us to get started.