Employee Cost Calculator: A Tool for Smarter Financial Planning

Employee Cost Calculator: Making Financial Planning Easier

How can automation help you to manage your organization's financial planning?

Let us help you with this informative guide about how to manage employee costs easily with an employee cost calculator.

What is it, how is it helpful, and why is it important to consider? We will uncover everything in this employee cost calculator guide.

Why is it essential to use an employee cost calculator?

Hiring a new employee involves more than just their salary. Companies need to understand all related costs to better manage their budgets and make smart decisions about hiring and keeping staff. This includes planning for things like staffing levels, budgeting, and overall financial strategy.

Using an employee cost calculator helps businesses weigh options like hiring full-time or part-time workers, or outsourcing tasks when necessary. Knowing the true cost of their employees helps companies improve their operations and make more effective decisions.

Do you know how much an employee actually costs? Try out our free employee cost calculator to check for yourself.

Factors To Consider When Calculating Employee Costs

When calculating employee costs, one must consider a multitude of factors: salary and benefit per employee--which encompasses health insurance and retirement contributions; training and development expenses; equipment outlays for the staff's operational needs; and supply replenishments that are integral to their tasks.

Further potential considerations could extend towards additional perks or privileges like providing a company car or phone–all these elements necessitate careful deliberation in the overall cost estimation process.

Businesses need to factor in the indirect costs of employee recruitment: these include managerial and supervisory expenses associated with hiring; further, there is an opportunity cost--not utilizing invested resources in that specific employee could mean preceding potential projects or investments.

Employee Cost Calculator Advantages

Optimizing Costs: By utilizing the employee cost calculator, you can pinpoint potential areas to minimize employee expenditures. For example, a reevaluation of your benefits package might reveal cost-saving opportunities that do not compromise employee satisfaction.

Improved Budgeting: Providing a clearer image of an employee's comprehensive cost – encompassing salary, benefits, payroll taxes, and miscellaneous expenses – empowers you to fabricate more precise budgets; this fosters superior financial planning and circumvents future surprises.

With the help of an employee cost calculator, understanding your total employee costs will enable you to guarantee that competitive compensation packages are offered; this strategy, in turn, attracts and retains top talent.

Knowing the complete cost of hiring with an employee cost calculator informs your decision-making during the recruitment process. This knowledge aids in resource allocation and ensures optimal value for your investment.

Global Hiring Support: Certain employee cost calculators, equipped to manage location-based factors, facilitate your estimation of costs tied to the recruitment of remote employees or personnel in diverse countries; this proves particularly advantageous for enterprises boasting a geographically dispersed workforce.

How To Determine Employee Cost?

Upon your examination of employee cost, you will discover it typically amounts to about 1.25 - 1.4 times the salary of a team member; this information should be invaluable in making strategic financial decisions for your organization.

The number, however, hinges on a trifecta of factors: the business owner's benefits; overhead costs – those necessary for daily operations such as rent or utilities; and lastly - it is determined by how many employees they have.

The Bureau of Labor's data reveals an average hourly salary cost of $26.86 for private industry team members. Concurrently, the average benefit-cost stands at approximately $11.22 per hour worked; this highlights a significant allocation towards benefits in overall compensation packages within these sectors.

U.S. business owners must provide certain mandatory taxes and employee benefits. Furthermore, they have the option to enhance these offerings by choosing additional perks such as 401K matching and tax-exempt transit credits.

As you onboard a new employee, remain aware of the comprehensive costs involved in their recruitment. Various factors necessitate consideration: worker's compensation, medicare taxes, and more.

The comprehensive breakdown of every aspect contributing to your cost per employee in the private sector proves instrumental for simplifying this process: you can leverage it to determine and manage your financial outlay more effectively.

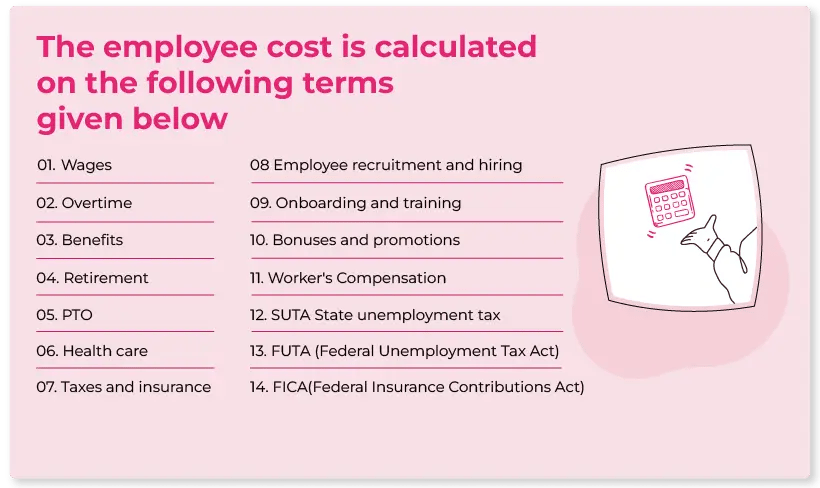

The employee cost is calculated on the following terms given below:

- Employee recruitment and hiring

- Onboarding and training

- Wages

- Overtime

- Bonuses and promotions

- Benefits

- Retirement

- PTO

- Health care

- Taxes and insurance

- FICA(Federal Insurance Contributions Act)

- FUTA (Federal Unemployment Tax Act)

- SUTA State unemployment tax

- Worker's Compensation

There Are Several Ways To Save Money On Employee Costs:

Offering competitive salaries and benefits packages can attract top talent and retain this talent–ultimately leading to reduced costs associated with training and onboarding new employees.

Using an employee cost calculator, you can implement a flexible work schedule, which can yield cost reductions in office space, utilities, and other overhead expenses.

Outsourcing non-critical tasks can reduce the necessity for a larger full-time workforce; it also mitigates associated benefits and overhead costs--an advantageous strategy.

Employing temporary or contract employees allows you to meet short-term staffing needs cost-effectively: You only pay for the work they perform.

Implementing a telecommuting policy can yield multiple benefits: It reduces the expenses tied to office space and utilities; concurrently, it elevates employee retention--a critical factor in enhancing productivity.

Encouraging employees to learn and develop their skills persistently can enhance their efficiency and effectiveness in their respective roles; ultimately, this leads to cost savings for the company.

Regularly reviewing employee expenses; this practice can facilitate the identification of areas for potential cost-cutting measures- specifically, reducing the external contractor count or enhancing negotiation with suppliers to secure more favorable rates.

How Do Costs Differ When Hiring Contractors vs. Full-Time Employees?

Hiring both contractors and full-time employees incurs costs: the specific expenses vary based on an individual's hourly or project rate, as well as provided benefits. Generally, a contractor--despite possessing similar skill sets to a full-time employee--may command higher per-hour charges; this reflects their lack of job security and associated benefits. Businesses, when they hire contractors, can economize on benefits such as health insurance, paid time off, and retirement plans.

Conversely, the engagement of full-time employees may incur elevated overall costs; this is a result of obligatory benefits. Alongside salary provisions, businesses are typically responsible for health insurance, remunerated time off--including retirement plans--and an array of miscellaneous perks. The potential advantages lie in the heightened company loyalty and commitment to long-term success often exhibited by these full-time staff members. The business's specific needs and budget will ultimately determine whether to hire a contractor or a full-time employee.

How Do Employee Costs Vary By State?

Several factors significantly influence the variation in employee costs across states. Among these, one crucial factor is the unique cost of living prevalent within each state; this can directly shape both wages and benefits expected by employees.

Let's understand with an example: states with a more elevated standard of living, like California and New York, may incur more extraordinary employee expenses compared to those embodying lower costs, such as Texas or Tennessee. The cost disparities are primarily due to variations in state-level standards for living; therefore, it is imperative to consider these factors when projecting employee expenditures with employee cost calculators at different geographic locations.

The prevalence of unions in each state can influence employee costs: higher rates of unionization within certain states may elevate these expenses. Such examples are consequences of collective bargaining agreements--contracts negotiated between a labor union and an employer--which frequently yield superior wages and benefits for employees affiliated with the union.

The regulatory environment in each state ultimately influences employee costs: states with more rigorous labor laws--California, for instance, impose higher expenses on employers due to overtime pay requirements and mandated breaks, among other benefits.

In sharp contrast, states that exhibit flexibility in their labor legislation may experience a reduction of these associated expenditures.

Employee Cost Calculator: Time Is Money—Save Both With Us!

Global Expansion's Total Cost of Employment calculator (TCoE) helps you estimate the costs associated with hiring and sustaining an employee in over 150 countries and territories. This tool includes wages, additional benefits, payroll taxes, and total expenditures. Companies can use the employee cost calculator to compare the financial consequences of different potential recruits and ensure that they comply with their financial objectives.

We provide global HR services anywhere in the world. Talk to our expert team about how we can simplify your global workforce HR and recruitment.

Subscribe to our blog

Receive the latest GX blog posts and updates in your inbox.