Doing business in Canada is becoming more attractive for many businesses looking to build an international presence. With a population of over 38 million, Canada has the ninth-largest economy globally and is home to a highly skilled workforce. Its strong economy, low corporate taxes, and geographic accessibility make it an ideal place for businesses to invest and grow.

According to a report by Invest in Canada, the country’s foreign direct investment has been impressive, reaching $75.5 billion in 2021. A CEIC report shows that in September 2022, there was a $12.6 billion increase in FDI compared to the previous quarter. These statistics show that Canada is the hub for many businesses worldwide.

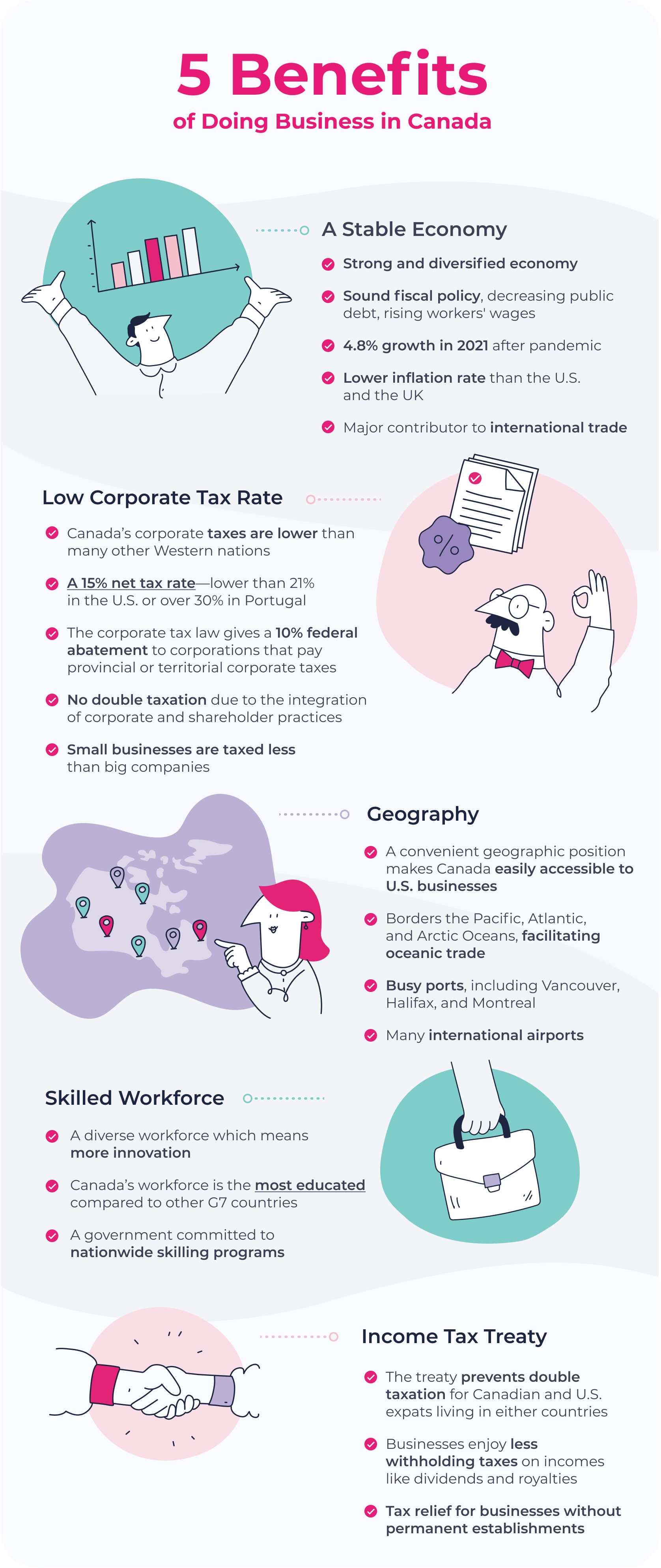

So, why is Canada becoming increasingly popular among entrepreneurs and businesses alike? This article answers the question by exploring five benefits of doing business in Canada.

1. Stable Economy

Canada boasts a strong and diversified economy resilient in the face of global economic challenges. The country's fiscal policy is sound, the public debt is decreasing, and workers' wages are rising. These factors provide businesses with a reliable environment for long-term investments and growth.

Consider Canada's economic stability:

- After the pandemic, the Canadian economy bounced back with 4.8% growth in 2021.

- Government support to facilitate business recovery and boost household incomes aided in the growth.

- Canada has a lower inflation rate than the United States and the United Kingdom, and the Canadian dollar is one of the hardest currencies in the world.

- International trade, including exports and imports, is a major contributor to Canada's economy.

Since the economy is stable, businesses operating in Canada can worry less about the possibility of economic downturns or market volatility.

2. Low Corporate Tax Rates

Canada's federal, provincial, and territorial governments have some of the lowest corporate income tax rates in the Western world. The net tax rate is 15%, and the federal rate for Canadian-controlled private corporations is 9%.

The tax rate is lower than 21% in the U.S. or in European countries like Portugal, where the tax rate exceeds 30%. Canada enjoys low corporate income tax rates because of various policies geared towards reducing businesses’ tax liabilities. These include:

- The corporate tax law of Canada allows corporations that pay provincial/territorial corporate income tax to receive a 10-percentage-point federal abatement, which lowers the corporate tax rate.

- The Small Business Deduction Deduction allows small businesses to pay a lower effective tax rate than large businesses.

- Integration of corporate and shareholder practices to prevent double taxation.

Your business pays less taxes and can save more money, which you can reinvest in your business operations or use to expand into new sectors.

3. Geography

Canada’s strong geographic position makes it one of the most accessible countries in the world. Businesses have easy access to some of the world's largest economies, paving the way for building an international team expansion. Geographically, the country is well-positioned for international business because:

- Canada borders the Pacific, Atlantic, and Arctic Oceans.

- The country has several busy ports, including Vancouver on the West Coast, Halifax on the East Coast, Prince Rupert in British Columbia, and Montreal in Quebec.

- Canada boasts several international airports, making it easy to travel in and out.

- The country has a long land border with the United States, facilitating even more trade between the two.

Canada's transit infrastructure and proximity to global markets will make it relatively easy to hire international talent. It will be easy to access the workforce, just like it will be easy for employees and other stakeholders in your company to access operations around Canada.

4. Skilled Workforce

If you hire a Canadian workforce when operating your business in the country, you will have access to some of the world's most innovative and hardworking people. The workforce has unique characteristics that position them for better productivity:

- The workforce is diverse, paving the way for more innovation, increased productivity, and a better bottom line for your business.

- Canada has one of the most highly educated workforces among G7 countries, with over half of Canadian adults holding a college or university credential.

- The government has nationwide programs that prepare people to thrive in the ever-changing work environment.

5. Income Tax Treaty

The income tax treaty outlines how Canadian and U.S. residents who live in one country and work in the other are taxed, and how these taxes should apply to investments and business activities spanning both countries. The treaty has benefits such as:

- Preventing double taxation of income earned by citizens of both countries, reducing the tax burden for expats.

- Allowing businesses to benefit from reduced withholding taxes on certain types of income, such as dividends, interest, royalties, and other payments made between the two countries.

- Relief from taxation on certain business profits that would otherwise be subject to taxation in both countries. For example, if a company has no permanent establishment in either country, its operating profits are not subject to Canadian income tax.

The income tax treaty will benefit your business by saving you money on taxes when you operate across borders. You will do business in both countries without worrying about double taxation.

Get Ready to Do Business in Canada

Canada provides an ideal business environment for entrepreneurs and companies exploring international markets. With its reliable transit infrastructure, skilled workforce, and favorable income tax treaty, you shouldn't hesitate to take advantage of Canada’s business opportunities.

However, hiring in Canada can be a time-consuming and complex process, especially if you choose to establish a legal entity. With Global Expansion, we simplify the process with our Employer of Record (EOR) services—without the need set up an entity.

As your EOR provider, we become your global team’s legal employer and handle all HR responsibilities while you retain daily management and operational oversight. That means you’ll hire faster, skip entity establishment, offer competitive benefits, and avoid misclassified contractor risks.

Contact us today to start building your world-class global team with the help of our EOR services.

Subscribe to our blog

Receive the latest GX blog posts and updates in your inbox.

.webp?width=820&height=444&name=Canada%20(1).webp)